Updated 6 January 2015

With the new year upon us and the confusing VAT MOSS regulations in place, we thought it important to revisit our guide to the new legislation – especially since that towards the end of the year the government announced an update and additional guidance. In a document published in December 2014, the government issued a document offering clarification to who and what is affected by the new laws. Go straight to the new info.

What is VAT MOSS?

From 1 January 2015, a new regulation has come into place where VAT on digital products sold in the EU will be chargeable in the place of purchase rather than the place of supply. VAT MOSS – or VAT Mini One Stop Shop to give it its full name – is being introduced to stop big corporations such as Amazon diverting sales through low-VAT countries such as Luxembourg. But it affects smaller companies and sole traders – who have significantly less resource for such tasks – on a larger scale.

It's fair to say that #VATMOSS has sparked panic on social media amongst creatives. After all, as design, motion, illustration or web professionals we deal in digital delivery. Our work is sent digitally across the EU and indeed the globe to our clients. Unless you are a very successful freelancer, the issue of VAT has probably never come into play. And the good news is, it may still not.

You see, VAT MOSS only applies to digital products being sold to consumers in the EU. A good way to think of it is like this: if you design a logo for a client then you are offering a service to a business, and you needn't change anything. If you're simply a freelance illustrator or designer, VAT MOSS does not affect you. However, if you are also selling logo templates and so on through your own website – that are marketed to consumers – you're possibly going to have a whole load of paperwork to do. A crippling amount, in fact.

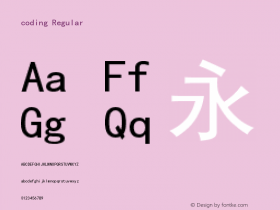

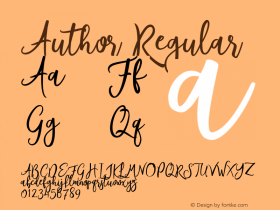

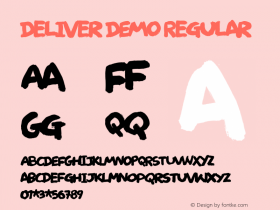

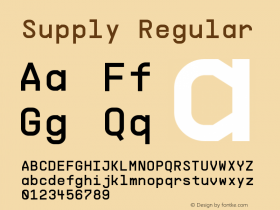

It's important to reiterate that the VAT MOSS regulation applies to digital products only. So that means prints, tees, books and the like are not affected. But if you're selling ebooks, downloadable training, tutorials, images, PSDs, games, WordPress or motion templates or typefaces, you need to comply with the regulation.

Who's affected by VAT MOSS? (new info)

Of particular interest to creative professionals, is the following information, outlining exactly what e-services are covered by the change in rules. If you sell any of the following to consumers, the VAT changes will affect you.

• Images or text, such as photos, screensavers, e-books and other digitised documents e.g. PDF files

music, films and games, including games of chance and gambling games, and of programmes on demand

• Online magazines

• Website supply or web hosting services

• Distance maintenance of programmes and equipment

• Supplies of software and software updates

• Advertising space on a website

If you sell purely to other businesses, the VAT changes won't affect you though.

So that clears a lot of things up for creatives. In addition, there's a table aiming to clarify things further, with popular e-services covered. Of note, 'online courses consisting of pre-recorded videos and downloadable PDFs plus support from a live tutor' are not covered by the new rules, but 'online course consisting of pre-recorded videos and downloadable PDFs' are covered. Crystal clear, right? It seems as though when you offer 'live' tutorials as part of the package then VAT MOSS doesn't come into play – something to think about.

There's also – and you may already know this – the fact that you only have to register for VAT MOSS if you make a sale. You need to notify HMRC by the 10th day of the month following the the month you supply an e-service. So if you make a sale this month (Jan) you'll need to notify HMRC by 10 Feb and register for VAT MOSS. The fact is though, you'll still need to be VAT registered if selling e-services online, but you won't lose your UK VAT registration threshold (currently £81,000). According to the excellent summary at Enterprise Nation: 'Registering voluntarily for VAT will only involve filing a quarterly 'nil' return – it is only the VAT MOSS return that then needs to be completed to reflect cross-border trade in the quarter'.

Data collection laws have also been simplified, and you only now need to ask the customer which member state they are a resident of at the point of sale, and get a billing address.

VAT MOSS is still undoubtedly confusing, and will still throw up problems for creatives selling this kind of service. However, thankfully, HMRC has offered some clarification on the new legislation – even if it's still not the turnaround that many were hoping for.

There are, essentially, two ways of complying. You can either register for VAT in each of the EU Member States where you have customers (there are 28 EU countries with 75 different rates of VAT!) or voluntarily register for VAT in the UK and then submit a VAT MOSS return online – and then HMRC will divvy out the payment to each relevant country's tax authority. The most worrying fact though is that if you sell a digital product to anyone in Europe – even if it's just a $10 font, say – you have to be VAT registered, meaning you have to charge VAT on all of your goods or services offered. Unlike standard VAT registration, where there's an £81,000 turnover threshold, there is no minimum amount you have to sell to comply with the VAT MOSS law.

"The major oversight with this law is no thresholds are upheld," emphasises designer Chris Spooner – a creative who, as well as offering graphic design and illustration services, provides a membership service where designers can download templates, typefaces, textures, vectors and more. "If a single person from Bulgaria pays $7 for a one month membership on my website, according to this law I must register for VAT in Bulgaria and pay €1.12 in tax. Unless I learn Bulgarian and personally contact the authorities in ????? to register for tax, I must sign up for MOSS here in the UK."

He continues: "In order to use the MOSS scheme I must be VAT registered, despite being well below the UK threshold. That means I'd then need to submit quarterly returns and lose 20 per cent of my entire income in VAT, even from my design services that aren't targeted in this EU law. Oh, and don't forget that I must keep evidence of this person's address, bank location, IP address or land line telephone number for ten years, which drops me into the laws surrounding data protection for personally identifiable information."

And he's right. Under VAT MOSS, you have to determine the place of purchase by providing two of the following (and the below is directly from gov.uk):

• The billing address of the customer

• The Internet Protocol (IP) address of the device used by the customer

• Location of the bank

• The country code of SIM used by the customer

• The location of the customer's fixed land line through which the service is supplied to him

• Other commercially relevant information (for example product coding information which electronically links the sale to a particular jurisdiction)

To add to Spooner, you need to keep VAT MOSS records for 10 years from 31 December of the year during which the transaction was carried out. Of course, for those of us who use the likes of PayPal rather than a bespoke online shop, asking for customer details beyond the standard email address can become intrusive and could undoubtedly affect sales.

Also, the admin issue is massive one. If you're only making a few hundred pounds by selling your digital products every year, how much time can you allocate to filling in forms? And how much admin does it involve?

Well, you'll need to know the VAT rates that apply to your products in all the countries you sell to, so if someone from Finland – 21 per cent VAT – buys your downloadable product, what's the cost and how do you show this on your website? You also need to make sure your VAT invoices to customers in other countries comply to that country's regulations. VAT MOSS returns are due every quarter, and can't be paid by direct debit, so you need to keep track of that.

If you can, according to HMRC, distinguish and organise your business between UK sales and sales to EU customers, you can register for VAT in the UK for the cross border part of your business only – and then sign up to VAT MOSS. Confusing? You bet. If you don't already have an accountant, now is the time to get one if this affects you.

Bear in mind all of this only applies if you are selling to consumers. If you market digital products to businesses only, the VAT MOSS regulation doesn't apply. But as Rachel Andrew – web developer and managing director of edgeofmyseat.com – notes on her blog, there's complications with proving just who a business customer is: "The only sure way to identify a business customer is via their VAT number," she says. "Many small businesses and freelancers are not VAT registered and so will generally need to be treated as a consumer for tax purposes." As the gov.uk guide states, 'If you supply digital services and your customer doesn't provide you with a VAT registration number (VRN) then you should treat the supply as B2C.'

If you sell your digital wares through a marketplace or established store (Paddle for instance, or even the App Store or Google Play) you don't need to do anything further as the store will already be complying with the regulation. The sad thing is, micro-businesses are being forced into using larger marketplaces rather than selling direct to their customers – pushing up prices (due to commission) and taking the 'person' out of the sale (which is often so important in the creative industries).

So what can you do about it? Well, you could, of course, stop selling your digital products. You need to weigh up whether your sales are worth the red tape and the effect that registering for VAT will have on the rest of your creative business. Or you could simply move your existing digital products to a recognised marketplace or store who will take responsibility for the new VAT regulation – this is by far the easiest approach. However, you can't do this with membership sites such as those run by Chris Spooner.

And that's why the designer recently wrote a letter to HMRC detailing the complications and financial detriment of this law to micro-businesses such as his. There's also a petition you can sign directed at the Secretary of State for Business, Innovation and Skills, Vince Cable.

Patricia van den Akker, Director of The Design Trust – a resource for designers wanting to start their own business – has some further advice: ""For sole traders who are close to the VAT threshold the best step is to indeed grow their business and become VAT registered," she says. "For sole traders with a lower turnover and small income from digital products it probably is best to stop that part of their business. It is that group that will be hardest hit. I think a big issue with VAT MOSS has also been that the information from HMRC has been very poor so far, and many freelancers and sole traders do not want to register for VAT, but are now confronted with an extra paperwork burden with very limited time to implement it now before the New Year."

Whatever you do, if you don't comply with the VAT MOSS regulation by 1 January and continue to sell digital products to customers in the EU, you'll be in big trouble – and could face an 'unlimited' fine. With the government promising more support for small businesses, you would hope that it will intervene (by introducing a threshold at least) and prevent many freelancers who have (not exactly lucrative, yet important and fulfilling) micro-businesses from canning their digital sideline projects.

Find out more about VAT MOSS and how it affects you at www.gov.uk/register-and-use-the-vat-mini-one-stop-shop.